Editor’s note: We fully updated this guide in February 2026 to make “lowest fees” a real cost comparison, not just a list of advertised maker/taker rates. The refresh adds a spot + perps fee table, a dollars-not-percent “real cost” breakdown, and a withdrawal-cost sanity check that shows how one monthly on-chain withdrawal can erase trading-fee savings. We also expanded coverage to include MEXC, Gate, Coinbase One, Phemex, Strike, River, and DEX aggregators (Matcha/1inch/Best Wallet), plus a new winner list by use case, decision matrix, and a clearer section on hidden costs so readers can pick the cheapest option for how they actually trade.

Crypto trading fees look simple until you actually try to compare them. One exchange advertises “zero fees,” another flashes tiny maker rates, and a third promises big discounts if you trade enough volume. But once you factor in spreads, withdrawal costs, subscriptions, and where you live, the cheapest option on paper can end up costing more in real life.

In this guide, we break down the lowest fee crypto exchanges across spot and perpetuals, show how to translate percentage fees into dollars, and highlight the hidden costs that quietly eat your savings. You will also get quick picks by category, a simple cost formula you can reuse, and practical tips to cut fees without taking on unnecessary risk.

Quick Answer

If you want the fast shortlist: below are the best “low-fee” picks by use case. The right winner changes with your volume, your order type, and your real-world costs (spreads, withdrawals, region limits).

Winner list (by category)

- Lowest overall trading fees: MEXC 0.00% maker and 0.05% taker for spot at entry tier. The catch is that low fees do not guarantee low total cost on every token, since spreads can widen on less liquid pairs.

- Best for high-volume fee tiers: Kraken Pro (clear tiering and meaningful maker drops once you’re trading at scale).

- Best “pay monthly, trade cheaper” option: Coinbase One (subscription can beat per-trade fees if you trade often enough, but the spread still matters and plan limits apply).

- Best for Bitcoin-only buys: Strike / River (simple BTC-only flows; “zero-fee” style perks often come with constraints, and execution/spread still counts).

- Best DEX option: Matcha / 1inch / Best Wallet (platform fees can be low, but gas, slippage, and MEV can become the real bill).

- Best “balanced” pick: Binance (liquidity is often the hidden discount; add BNB discounts where they fit your workflow).

- Best for altcoin hunters: KuCoin / Gate.com (wide catalogs, but double-check compliance/availability in your region and expect more variance in liquidity on the long tail).

Fee Warning

Low fees ≠ low total cost.

- Spreads & slippage: Can dwarf “cheap” fees on thin pairs.

- Withdrawal fees: One monthly withdrawal can erase fee savings.

- VIP resets: Trailing-volume tiers can bump your rate back up.

- Region limits: Products and onboarding vary by country/entity.

- DEX risks: Smart contract, wallet security, MEV, and gas volatility.

Fee Comparison Table

| Exchange | Spot maker/taker | Perps maker/taker | Volume discount threshold where meaningful | Subscription option | Best for | Hidden cost risk |

|---|---|---|---|---|---|---|

| MEXC | 0.00% / 0.05% | 0.00%~0.01% / 0.00%~0.04% | VIP 1 starts at 10,000,000 USDT 30 day volume | No | Low headline fees on many pairs | Liquidity and spreads can vary more on smaller pairs |

| Binance | 0.10% / 0.10% | 0.02% / 0.05% | VIP 1 starts at 1,000,000 USD 30 day spot volume | No | Deep liquidity on major pairs | Regional restrictions and entity specific product availability |

| KuCoin | 0.10% / 0.10% | 0.02% / 0.06% | VIP 1 spot volume requirement set to 1,000,000 USD in the program update | No | Broad market access across many assets | Regional access differences and higher slippage risk on thin pairs |

| Bitget | 0.10% / 0.10% | 0.02% / 0.06% | VIP perks referenced from 500,000 USDT spot volume in the VIP upgrade notice | No | Spot plus perps with a simple base fee model | Spreads and liquidity vary widely across long tail listings |

| Bybit | 0.10% / 0.10% | 0.02% / 0.055% | VIP 1 starts at 1,000,000 USD 30 day spot volume | No | Active derivatives users who want clear base pricing | Product specific fee tables and regional restrictions on derivatives |

| Gate.com | 0.10% / 0.10% | 0.02% / 0.05% | VIP 1 starts at 60,000 USD 30 day spot volume on Gate | No | Very large asset catalog | Spreads and execution can vary heavily on smaller listings |

| Phemex | 0.10% / 0.10% | 0.01% / 0.06% | VIP 1 begins at 800,000 USD 30 day volume in the VIP program criteria | No | Straightforward spot and perps fee baseline | Smaller markets can carry higher slippage |

| Kraken Pro | 0.25% / 0.40% | 0.02% / 0.05% | First spot tier change begins after 10,000 USD 30 day volume | No | Users who value a transparent tier schedule | Perps availability depends on region |

| Coinbase One | Zero trading fees on eligible assets, spread applies | Not included in Coinbase One benefits | No tiers. Basic package starts from Up to 500 USD per month | Yes, tiers with limits and disclosures | Frequent small buys where subscription benefits fit | Spread and monthly limits can outweigh the subscription value |

| Strike | Brokerage style pricing with a tiered Strike fee starting from 0.99% | No | Fee tiers are based on monthly trading volume | No | Simple Bitcoin buying and selling | Total cost depends on the quoted execution price |

| River | Brokerage style pricing, with zero fee recurring buys after seven days | No | Not a maker taker tier schedule | No | Bitcoin only recurring accumulation | Total cost can include spread and execution style differences |

| DEX wallets and aggregators like Matcha and 1inch | No maker taker model | No | Not applicable | No | Self custody swapping and routing | Gas, slippage, and MEV can dominate total cost |

Real Cost Analysis

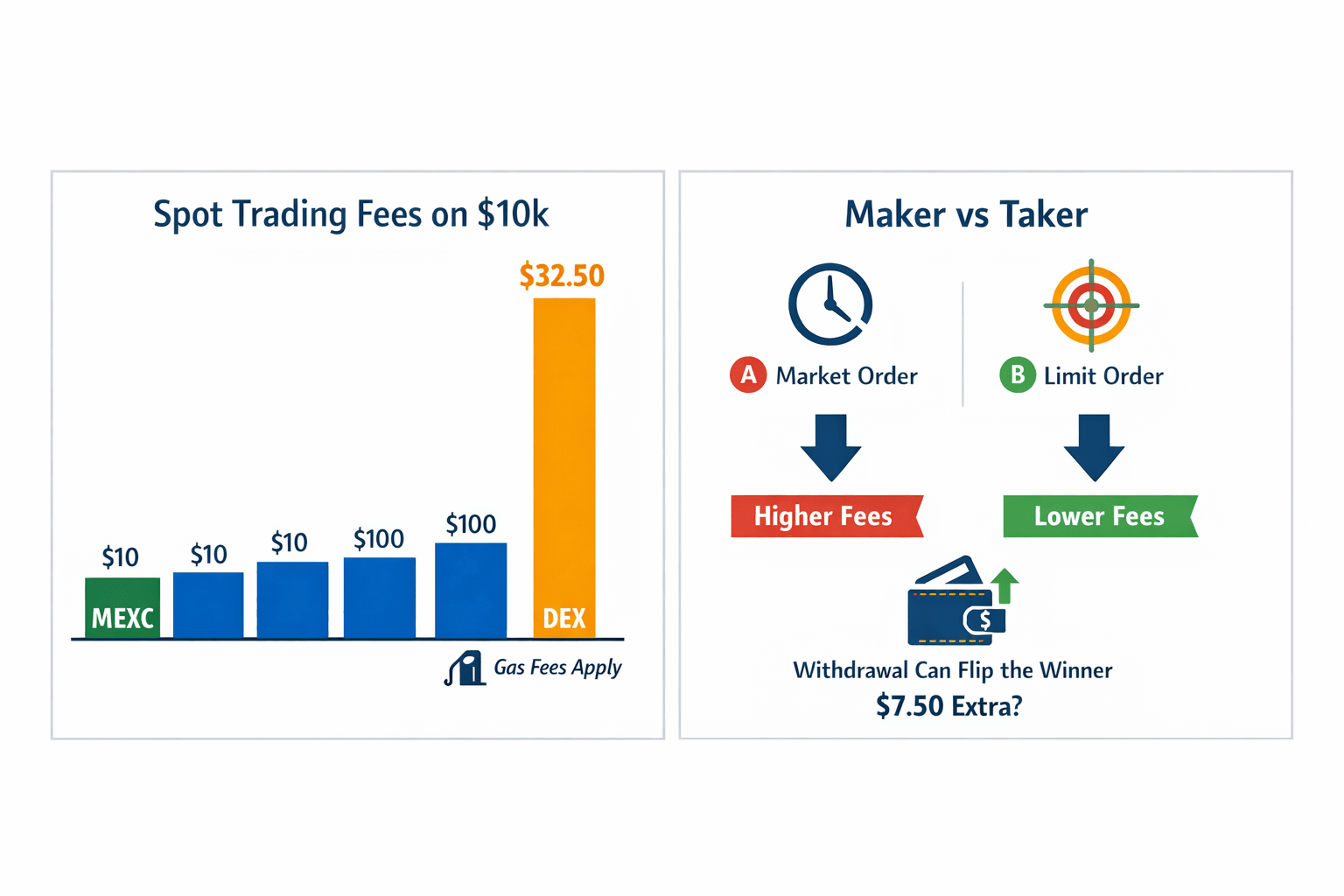

Now let's translate maker and taker fees into dollars, so you can compare exchanges without doing mental math. If you want a refresher on how the maker and taker model works, the short version is simple: makers usually pay less for providing liquidity, takers usually pay more for instant execution.

Makers Usually Pay Less for Providing Liquidity, Takers Usually Pay More for Instant Execution

Makers Usually Pay Less for Providing Liquidity, Takers Usually Pay More for Instant ExecutionWhat You’d Actually Pay

Estimated spot trading fees at entry level tiers

| Exchange | $1,000 trade | $10,000 trade | $100,000 trade | Annual cost (100K monthly) |

|---|---|---|---|---|

| MEXC | $0.25 | $2.50 | $25.00 | $300.00 |

| Binance | $1.00 | $10.00 | $100.00 | $1,200.00 |

| KuCoin | $1.00 | $10.00 | $100.00 | $1,200.00 |

| Bitget | $1.00 | $10.00 | $100.00 | $1,200.00 |

| Bybit | $1.00 | $10.00 | $100.00 | $1,200.00 |

| Gate.com | $1.00 | $10.00 | $100.00 | $1,200.00 |

| Phemex | $1.00 | $10.00 | $100.00 | $1,200.00 |

| Kraken Pro | $3.25 | $32.50 | $325.00 | $3,900.00 |

| DEX aggregators (Matcha, 1inch) | $0.00 | $0.00 | $0.00 | $0.00 |

Assumptions used for the table:

- Excludes spreads unless stated.

- Excludes network gas and routing costs for DEX trading, which can be the biggest line item on some networks.

Two Scenarios

Scenario A: Market order heavy

- This is the convenience route. You value speed and certainty, so you hit the taker rate more often, like paying extra for same day delivery.

Scenario B: Limit order heavy

- This is the patient route. You try to earn maker pricing by waiting for the market to come to your order, like setting a budget and refusing to overpay.

Mini comparison

- Mostly market orders means your effective rate often sits closer to taker.

- Mostly limit orders means your effective rate often sits closer to maker.

- Mixed styles often land near the 50 percent midpoint used above.

Withdrawal Costs That Can Flip the Winner

The next table shows the break even point where one monthly withdrawal can wipe out the trading fee savings from choosing a lower fee exchange. It uses the difference between MEXC and each exchange’s spot fees, then applies that threshold to common withdrawal checks: BTC, ETH, USDT on TRON, and USDT on Ethereum.

Trade fee savings vs one withdrawal per month

| If you choose MEXC instead of | $1,000 trade | $10,000 trade | $100,000 trade | Annual cost (100K monthly) |

|---|---|---|---|---|

| Binance | $0.75 | $7.50 | $75.00 | $900.00 |

| KuCoin | $0.75 | $7.50 | $75.00 | $900.00 |

| Bitget | $0.75 | $7.50 | $75.00 | $900.00 |

| Bybit | $0.75 | $7.50 | $75.00 | $900.00 |

| Gate.com | $0.75 | $7.50 | $75.00 | $900.00 |

| Phemex | $0.75 | $7.50 | $75.00 | $900.00 |

| Kraken Pro | $3.00 | $30.00 | $300.00 | $3,600.00 |

How to use it: If you trade about $10,000 per month and your chosen platform saves $7.50 in trading fees, then paying more than $7.50 extra for a single monthly withdrawal on BTC, ETH, USDT TRC20, or USDT ERC20 can flip which option is cheaper overall.

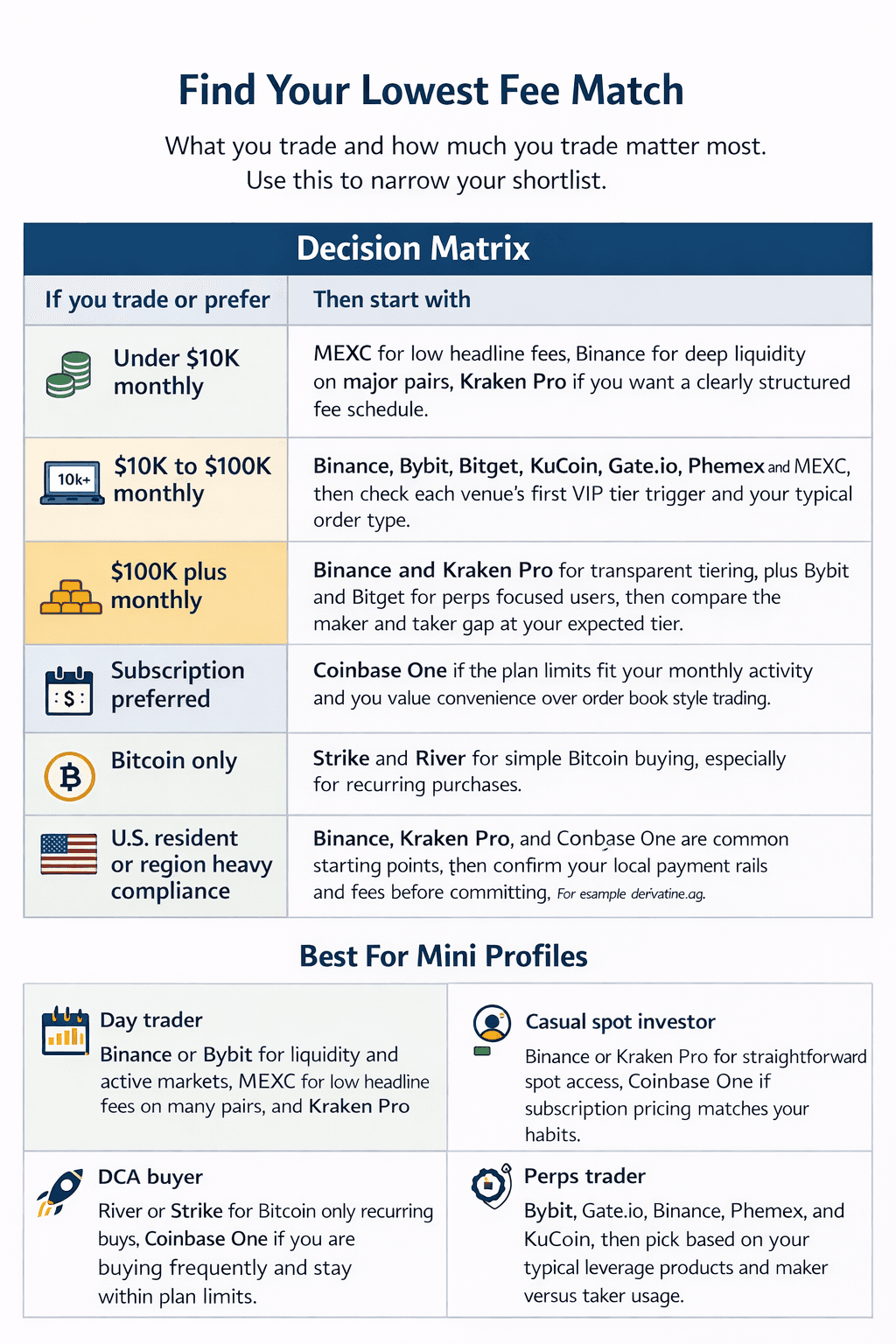

Find Your Lowest Fee Match

If you focus on one thing only, make it this: the cheapest exchange depends on how much you trade, what you trade, and where you live. Use the quick grid below to narrow your shortlist before you compare the fine print.

The Cheapest Exchange Depends on How Much You Trade, What You Trade, and Where You Live

The Cheapest Exchange Depends on How Much You Trade, What You Trade, and Where You LiveDecision Matrix

| If you trade or prefer | Then start with |

|---|---|

| Under $10K monthly | MEXC for low headline fees, Binance for deep liquidity on major pairs, Kraken Pro if you want a clearly structured fee schedule. |

| $10K to $100K monthly | Binance, Bybit, Bitget, KuCoin, Gate.com, Phemex and MEXC, then check each venue’s first VIP tier trigger and your typical order type. |

| $100K plus monthly | Binance and Kraken Pro for transparent tiering, plus Bybit and Bitget for perps focused users, then compare the maker and taker gap at your expected tier. |

| Subscription preferred | Coinbase One if the plan limits fit your monthly activity and you value convenience over order book style trading. |

| Bitcoin only | Strike and River for simple Bitcoin buying, especially for recurring purchases. |

| DEX preferred | Matcha and 1inch if you want self custody swapping and you are comfortable paying network costs. |

| U.S. resident or region heavy compliance | Start with venues that clearly state what is available in your country. For example, derivatives availability can differ by region even when spot is offered. |

| Needs fiat ramps | Binance, Kraken Pro, and Coinbase One are common starting points, then confirm your local payment rails and fees before committing. |

Best For Mini Profiles

- Day trader: Binance or Bybit for liquidity and active markets, MEXC for low headline fees on many pairs, and Kraken Pro if you want a clear fee schedule and strong controls.

- Casual spot investor: Binance or Kraken Pro for straightforward spot access, Coinbase One if subscription pricing matches your habits.

- DCA buyer: River or Strike for Bitcoin only recurring buys, Coinbase One if you are buying frequently and stay within plan limits.

- Perps trader: Bybit, Bitget, Binance, Phemex, and KuCoin, then pick based on your typical leverage products and maker versus taker usage.

- Altcoin explorer: MEXC, Gate.com, KuCoin, and Bitget, with extra attention to spreads and liquidity on smaller pairs.

- Privacy seeking user: A DEX route through Matcha or 1inch can reduce reliance on a single custodian, but it introduces smart contract and wallet security risks, plus network fees that can be unpredictable.

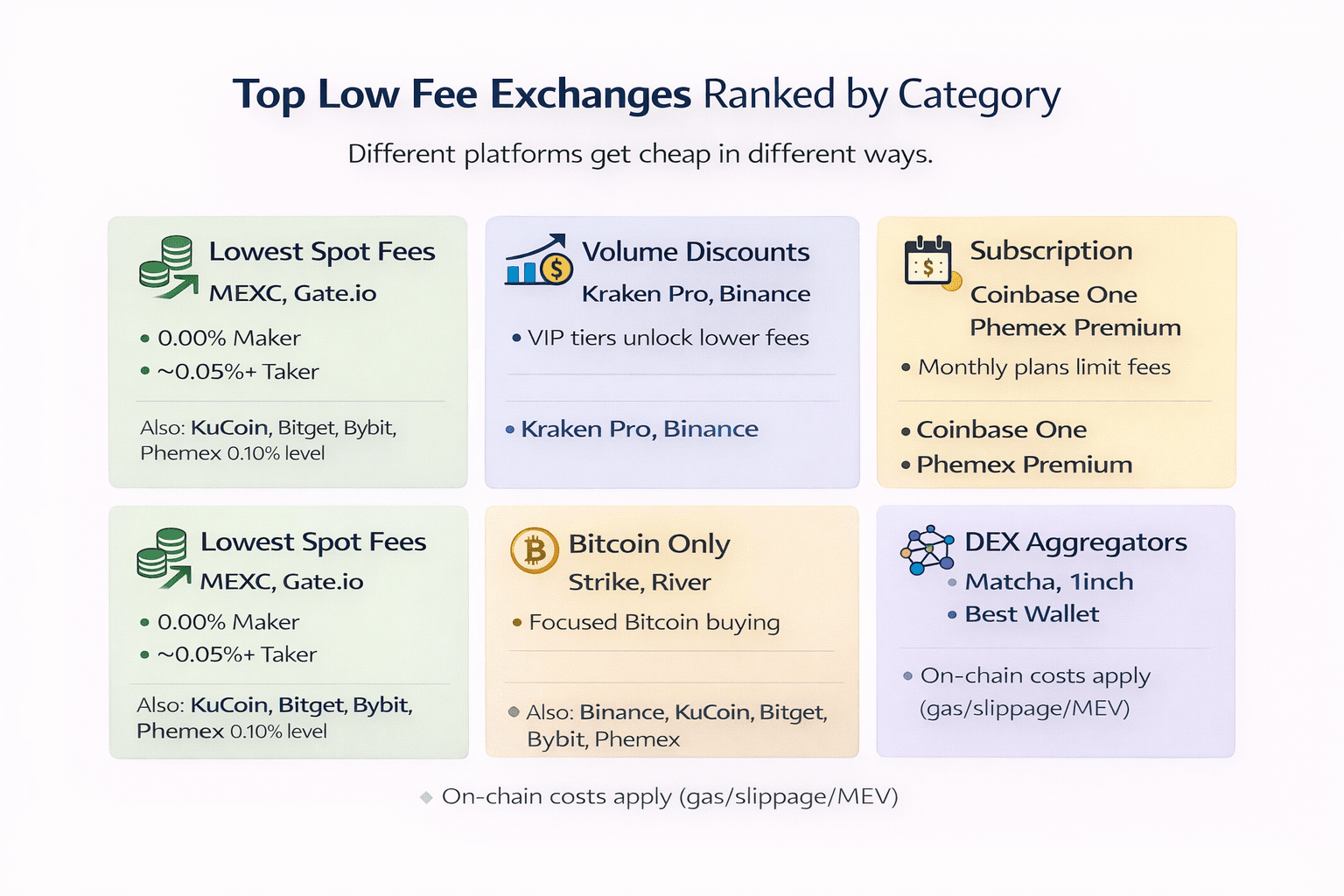

Top Low Fee Exchanges Ranked by Category

Different platforms get cheap in different ways. Some keep entry level trading fees low. Others reward volume. A few bundle trading into a subscription. And DEX aggregators can advertise a near zero platform fee while the real cost shows up as gas, slippage, and MEV.

Different Platforms can be Cheap in Different Ways

Different Platforms can be Cheap in Different WaysLowest Spot Trading Fees

MEXC

Spot fees at the entry tier are 0.00% maker and 0.05% taker. Conditions still matter, so it is worth checking whether a pair is subject to special pricing, token based discounts, or campaign rules before assuming that rate applies everywhere. Even with low fees, spreads can still dominate on thin markets, meaning the gap between the buy and sell price can cost more than the fee.

Gate.com

Spot fees at the entry tier are 0.10% maker and 0.10% taker. As volume increases, fees can change based on tiering rules and venue specific requirements. The big caution is liquidity dispersion across a large catalog. Major pairs tend to be efficient, while smaller listings can have wider spreads and more slippage.

Note: The 0.10% maker taker fee also applies to Binance, KuCoin, Bitget, Bybit, and Phemex. It all comes down to the other variables as we have continued to mention that can affect the overall trading cost. These choices all have their pros and cons and just a similar spot fee does not mean a similar overall trading cost across each platform.

Best Volume Based Discounts

If you trade enough, volume tiers can matter more than the headline entry rate, especially if you place a lot of limit orders and benefit from lower maker fees.

Kraken Pro

| 30 day volume in USD | Maker | Taker |

|---|---|---|

| $0 or more | 0.25% | 0.40% |

| $10,000 or more | 0.20% | 0.35% |

| $50,000 or more | 0.14% | 0.24% |

| $100,000 or more | 0.12% | 0.22% |

| $250,000 or more | 0.10% | 0.20% |

| $10,000,000 or more | 0.00% | 0.10% |

One standout feature is 0.00% maker at the $10,000,000 tier. A practical warning is that your tier depends on trailing activity, so your effective rate can move up or down as your recent volume changes.

Binance

| VIP level | 30 day spot volume in USD | Maker | Taker |

|---|---|---|---|

| Regular | Under 1,000,000 | 0.100% | 0.100% |

| VIP 1 | 1,000,000 or more | 0.090% | 0.100% |

| VIP 2 | 5,000,000 or more | 0.080% | 0.100% |

| VIP 3 | 20,000,000 or more | 0.040% | 0.060% |

| VIP 5 | 150,000,000 or more | 0.025% | 0.031% |

| VIP 8 | 2,000,000,000 or more | 0.016% | 0.025% |

Binance also offers optional levers such as BNB trading fee discounts. As with any tiered schedule, your tier depends on how the venue calculates trailing volume, so it is normal to see your rate shift over time.

Best Subscription Models

Subscriptions can make sense when you trade often enough that the subscription cost is lower than the trading fees you would otherwise pay, while still accepting that spreads can remain a cost.

Coinbase One

Zero trading fees on eligible assets comes with limitations and disclosures, including that spread applies. The break even logic is simple: if a plan costs $29.99 per month, your saved trading fees need to exceed $29.99 for that month. At a 0.10% trading fee elsewhere, that starts to look favorable around $30,000 traded.

Phemex Premium

Premium pricing is listed as 9.99 USDT per month, 19.99 USDT for 3 months, or 69.99 USDT per year. The published benefit includes zero spot fees up to stated caps, with overage charged at 0.1%. Break even is again a comparison between your subscription cost and the trading fees you would otherwise pay.

Best for Bitcoin Only

Bitcoin only services can be simpler for beginners because they remove token sprawl, but their costs are usually expressed as a fee schedule plus the execution price you receive, rather than maker and taker.

Strike

Strike uses tiered bitcoin trading fees, and total cost can also reflect the fees and rates that apply to bitcoin transactions, depending on how you fund and transact.

River

River’s model includes zero fee recurring buys after seven days. The key takeaway is that removing an explicit trading fee does not necessarily remove all costs, because execution and spread can still matter.

Best DEX Options for Low Platform Fees

DEX aggregators can reduce reliance on a single custodian, but you are trading platform fees for onchain costs and onchain risks.

Matcha and 1inch

1inch has no on top fees, while Matcha has a fee structure, based on different modes, trade types, and chains. Even if platform fees are near zero, gas fees, MEV, and slippage still apply.

Best Wallet Aggregator

Best Wallet includes an in-app swap feature (via its integrated Best DEX, powered by Rubic) that routes swaps across multiple exchanges and, where needed, cross-chain bridges to find competitive rates. Your final cost depends on network fees and execution factors such as price impact/slippage, so the practical check is comparing the quoted amount with the final amount received after confirmation.

Detailed Exchange Reviews

Now let's take a more focused view on each exchange and see what each is worth when it comes to trading with lowest fees.

MEXC

MEXC is a high volume exchange known for frequent listings and low headline fees. It has built a reputation among active traders for broad market coverage, though its experience can vary more by token and region than the largest “major pair” venues.

MEXC Suits Traders Who Prioritize Low Spot Fees and Want Access to a Wide Range of Altcoins. Image via MEXC

MEXC Suits Traders Who Prioritize Low Spot Fees and Want Access to a Wide Range of Altcoins. Image via MEXCFees: Spot trading is advertised at 0.00% maker and 0.05% taker, and MEXC lists its futures rates on the same fee hub for quick comparison.

Real World Example: If you trade $10,000 per month and most of that volume is taker fills, you’d pay roughly $5 in spot fees at a 0.05% taker rate.

Deposits & Withdrawals: Deposit and withdrawal costs depend on the funding method, the asset you’re moving, and the specific network or chain you choose.

Hidden Costs Check: On smaller or newer pairs, the spread and order book depth can matter more than the posted fee, so it’s worth checking the effective price you actually get.

Best For: MEXC tends to suit traders who prioritize low spot fees and want access to a wide range of altcoins and newer listings.

Avoid If: If you need consistently tight liquidity across most markets, you may find depth uneven outside the most active pairs.

Pros: Low headline fees can be attractive for frequent spot traders.

Cons: Liquidity and pricing quality can vary significantly depending on the token and region.

Check out our exclusive review of MEXC.

Binance

Binance is a liquidity first venue that tends to be strongest on major markets and trading tools. It is one of the most widely recognized crypto exchanges globally, with features and availability that can differ depending on the local entity serving your region.

Binance is One of the Most Widely Recognized Crypto Exchanges Globally. Image via Binance

Binance is One of the Most Widely Recognized Crypto Exchanges Globally. Image via BinanceFees: Spot fees typically start at 0.10% maker and 0.10% taker, while perpetual futures commonly list around 0.02% maker and 0.05% taker at the entry tier.

Real World Example: If you trade $100,000 in a month and your activity is roughly “mixed” at the 0.10% baseline, total spot fees could come out to about $100.

Deposits & Withdrawals: Deposit options and withdrawal costs vary depending on the fiat rail you use and the blockchain network selected for the asset.

Hidden Costs Check: Because Binance products and features can differ by region, it’s worth confirming what’s available under your local Binance entity before assuming you’ll have access to every tool.

Best For: Binance is generally best suited to traders who want deep liquidity on major pairs, a wide toolset, and an active trading environment.

Avoid If: If you prefer a minimalist interface and a smaller feature set, Binance can feel crowded or complex.

Pros: Deep order books on major markets often translate into tighter spreads and more consistent execution.

Cons: Regional differences in features and onboarding can add friction, especially if you expect a uniform experience across countries.

We have a lot more covered in our exclusive Binance Review.

KuCoin

KuCoin is an exchange often used for broad token access plus derivatives products. It is well known for listing a wide range of assets early, but users should pay close attention to regional availability and product limitations.

KuCoin Offers Broad Listings that Make it Easier to Access Smaller or Newer Tokens. Image via KuCoin

KuCoin Offers Broad Listings that Make it Easier to Access Smaller or Newer Tokens. Image via KuCoinFees: Spot trading is commonly listed at 0.10% maker and 0.10% taker, while futures fees are often shown around 0.02% maker and 0.06% taker at the base tier.

Real World Example: If you trade $10,000 per month and most fills are taker orders, you’d pay roughly $10 in spot fees at a 0.10% taker rate.

Deposits & Withdrawals: Deposit and withdrawal costs vary by asset and the blockchain network you select, so it’s worth checking fees before moving funds.

Hidden Costs Check: On thinner pairs, slippage and spread can outweigh the posted trading fee, so check the order book depth and the expected execution price.

Best For: KuCoin can fit traders who want access to a large selection of altcoins and also want the option of perpetuals.

Avoid If: If you primarily trade major pairs and don’t need a long tail of listings, you may not get much benefit from the added complexity.

Pros: Broad listings can make it easier to access smaller or newer tokens without using multiple platforms.

Cons: Some markets can be thin, which may lead to wider spreads and less predictable execution on certain pairs.

Don't miss our detailed review of KuCoin for more information.

Bitget

Bitget is a derivatives heavy platform with an active copy trading ecosystem. It has grown quickly in visibility among perps focused users, with its strongest reputation tied to trading features rather than simple beginner investing flows.

Bitget is a Derivatives Heavy Platform with an Active Copy Trading Ecosystem. Image via Bitget

Bitget is a Derivatives Heavy Platform with an Active Copy Trading Ecosystem. Image via BitgetFees: Spot trading is typically listed at 0.10% maker and 0.10% taker, while futures commonly show around 0.02% maker and 0.06% taker at the base tier.

Real World Example: If you trade $100,000 in a month and your spot activity is roughly “mixed” at the 0.10% baseline, total spot fees could be about $100.

Deposits & Withdrawals: Withdrawal costs depend on the asset and the blockchain network you choose, so the cheapest option can change depending on the chain you use.

Hidden Costs Check: A quick way to sanity-check execution is to compare the swap or order quote to the current last traded price, especially in fast markets.

Best For: Bitget tends to suit traders who prioritize perpetuals and want access to copy trading features as part of their workflow.

Avoid If: If you frequently trade illiquid long-tail pairs, pricing can be less consistent and execution quality may vary more than on the deepest venues.

Pros: Clear fee tables make it easier to estimate baseline trading costs before placing orders.

Cons: Withdrawal costs can vary by network and asset, which can meaningfully affect the all-in cost of moving funds on and off the platform.

Do read more details in our exclusive Bitget review.

Bybit

Bybit is a popular derivatives platform that also offers spot markets and VIP tiers. It is widely associated with active trading and perps liquidity, but access to specific products can depend on where you live.

Bybit is Widely Associated with Active Trading and Perps Liquidity. Image via Bybit

Bybit is Widely Associated with Active Trading and Perps Liquidity. Image via BybitFees: Spot trading is typically listed at 0.10% maker and 0.10% taker, while perpetuals commonly list around 0.02% maker and 0.055% taker at the entry tier.

Real World Example: If you trade $10,000 per month and most fills are taker orders, that’s roughly $10 in spot fees at 0.10%, or about $5.50 on perps at a 0.055% taker rate.

Deposits & Withdrawals: Deposit and withdrawal costs vary by asset and the network you use, so choosing a different chain can materially change your transfer fees.

Hidden Costs Check: For perpetuals, funding payments can add (or subtract) cost over time, so it’s worth checking the current and historical funding rates before holding positions.

Best For: Bybit tends to suit traders who mainly focus on perpetuals and value strong derivatives liquidity and trading tools.

Avoid If: If your region restricts access to certain Bybit products, the experience can be limited compared with what you see advertised globally.

Pros: Derivatives depth on major contracts can support tighter spreads and more reliable execution for active traders.

Cons: Regional variance in features and availability can create friction if you expect the same product set everywhere.

We have Bybit covered in much more detail for you to check out.

Gate

Gate.com is a large catalog exchange where pricing and liquidity vary by market. It has long been known for offering a wide selection of assets, which can be useful for niche exposure but also requires extra caution on spreads and slippage.

Gate.com is Best for Users Who Prioritize Altcoin Breadth and Want Many Markets in One Place. Image via Gate

Gate.com is Best for Users Who Prioritize Altcoin Breadth and Want Many Markets in One Place. Image via GateFees: Entry-level spot fees are commonly listed at 0.10% maker and 0.10% taker on Gate, though your actual tier can change with volume and eligibility.

Real World Example: If you trade $10,000 per month and most fills are taker orders, you’d pay roughly $10 in spot fees at the 0.10% baseline rate.

Deposits & Withdrawals: Funding and withdrawals depend on the method used, the asset you’re moving, and the blockchain network you select, so the cheapest route can vary by chain.

Hidden Costs Check: On smaller or newer listings, slippage can be a bigger cost than the headline fee, so check the order book depth and the expected execution price before trading size.

Best For: Gate.com is generally best for users who prioritize altcoin breadth and want many markets in one place.

Avoid If: If you want consistently deep liquidity across most pairs, the “long tail” of markets can be uneven and may lead to wider spreads.

Pros: A huge catalog makes it easier to access niche tokens without needing multiple exchanges.

Cons: Long-tail markets can experience meaningful slippage, which can raise the effective cost even when the posted fee looks low.

Coinbase One

Coinbase One is a subscription add on aimed at simplifying costs for frequent simple trades. It sits within the broader Coinbase ecosystem, which is often seen as more beginner friendly in design, with pricing tradeoffs that show up in spreads and plan limits.

Coinbase One is a Subscription Add-On on Coinbase. Image via Coinbase One

Coinbase One is a Subscription Add-On on Coinbase. Image via Coinbase OneFees: Coinbase One generally advertises $0 trading fees on eligible assets up to plan limits, but the spread still applies, meaning the all-in cost isn’t always zero.

Real World Example: If your monthly trading stays inside the plan’s cap, your explicit trading fee line item can be close to $0, but you’ll still pay indirectly through the spread between the buy and sell price.

Deposits & Withdrawals: Deposit and withdrawal costs depend on the funding method and the blockchain network used for any on-chain transfers.

Hidden Costs Check: A practical check is comparing the trade quote to an approximate mid-market price (or a tight reference market) to see how much spread you’re paying.

Best For: Coinbase One tends to fit users who value convenience, want fewer fee surprises, and prefer a more guided, beginner-oriented experience.

Avoid If: If you want granular order-book controls (like advanced limit-order workflows across many venues), a subscription wrapper may feel restrictive.

Pros: The “subscription for simpler costs” model can be easier to understand than per-trade fees for frequent, small trades.

Cons: Spreads and plan caps can still make costs meaningful, especially if you trade outside eligible assets or exceed the included limits.

You can check out our Coinbase Review for more details.

Phemex

Phemex a venue with straightforward published fees and optional membership features. It is generally positioned as a trading focused platform rather than a pure on ramp, with its appeal depending on whether you use spot, derivatives, or membership benefits.

Phemex also Gives Optional Membership Features. Image via Phemex

Phemex also Gives Optional Membership Features. Image via PhemexFees: Spot trading is typically listed at 0.10% maker and 0.10% taker, while contracts are commonly shown around 0.01% maker and 0.06% taker at the base tier.

Real World Example: If you trade $10,000 per month and most fills are taker orders, you’d pay roughly $10 in spot fees at the 0.10% baseline rate.

Deposits & Withdrawals: Deposit methods and withdrawal costs depend on the fiat rail (if used), the asset, and the blockchain network selected for transfers.

Hidden Costs Check: On smaller pairs, limited liquidity can widen spreads and increase slippage, so it’s worth checking depth before trading size.

Best For: Phemex can suit traders who want clearly published fee baselines and also want access to perpetuals without hunting for hidden pricing.

Avoid If: If you need consistently top-tier depth across a wide set of markets, execution quality may vary outside the most active pairs.

Pros: Transparent fee schedules make it easier to estimate baseline costs before you place trades.

Cons: Slippage risk can be meaningful on less-liquid markets, which can raise the effective cost beyond the posted fee.

Don't miss the details in our Phemex Review.

Strike

Strike is a Bitcoin focused app that uses brokerage style pricing rather than an order book. It is best known for making bitcoin buying and spending feel closer to a payments app experience than an exchange terminal.

Strike Uses Brokerage Style Pricing rather than an Order Book. Image via Strike

Strike Uses Brokerage Style Pricing rather than an Order Book. Image via StrikeFees: Strike uses tiered Bitcoin trading fees (rather than maker/taker pricing) and does not offer perpetual futures.

Real World Example: If you buy or sell $10,000 per month, your total cost depends on your tier and the quote you receive at the time, not on whether you place maker or taker orders.

Deposits & Withdrawals: Costs and speed depend on your funding method, while Bitcoin withdrawals are governed by the Bitcoin network and can vary based on network conditions.

Hidden Costs Check: A practical check is comparing Strike’s quote to a reliable spot reference price to understand the effective spread you’re paying.

Best For: Strike is generally best for users who want simple, straightforward Bitcoin buys and a payments-style experience rather than a trading interface.

Avoid If: If you want altcoin markets, advanced order types, or perpetuals, Strike won’t be a fit because it’s intentionally Bitcoin-centric.

Pros: The Bitcoin-only focus can make the app feel simpler and less cluttered than a multi-asset exchange.

Cons: Without an order book, you have less control over execution mechanics compared to exchanges that support limit orders and depth-based price discovery.

River

River is a Bitcoin only platform that emphasizes recurring buys and custody services. It has built its brand around long term bitcoin accumulation and custody oriented features rather than broad multi asset trading.

River is a Bitcoin Only Platform. Image via River

River is a Bitcoin Only Platform. Image via RiverFees: One-time buys use a tiered fee table, while recurring buys can drop to 0.00% after seven days, and River does not offer perpetual futures.

Real World Example: If you dollar-cost average $10,000 per month and qualify for the 0.00% recurring-buy tier, your explicit trading fee can be close to zero, but the execution price still determines your true all-in cost.

Deposits & Withdrawals: On-chain Bitcoin withdrawals incur network fees, which can vary depending on network conditions and the fee rate used at the time.

Hidden Costs Check: Even with low or zero listed fees, compare the quote to a reliable spot reference to sanity-check spread and execution quality.

Best For: River is best suited to users who want a Bitcoin DCA workflow and custody-focused features rather than active multi-asset trading.

Avoid If: If you want multi-asset trading, altcoins, or derivatives, River’s Bitcoin-only approach will be too limiting.

Pros: The platform is DCA-friendly and designed around recurring accumulation, which can simplify long-term buying.

Cons: Being Bitcoin-only means you won’t have access to broader markets, altcoin exposure, or perps.

DEX Wallets (Matcha and 1inch)

Self custody swapping through aggregators that route orders across on chain liquidity. These tools are well known among on chain users for price routing and convenience, but they shift responsibility to you for wallet security, gas management, and transaction finality.

Self-Custody Gives You More Direct Control Over Asset Management. Image via 1inch

Self-Custody Gives You More Direct Control Over Asset Management. Image via 1inchFees: Matcha notes a 0.10% fee on certain chains in addition to gas, while 1inch states it charges no extra (on-top) fees, though network gas fees still apply either way.

Real World Example: If you swap $10,000 on Ethereum mainnet, gas can easily exceed any aggregator fee, whereas using an L2 can materially reduce network costs.

Deposits & Withdrawals: Funding and “withdrawals” are simply on-chain transfers, and cross-chain activity typically relies on bridges rather than exchange-style rails.

Hidden Costs Check: Watch for price impact and the minimum received value, and be aware that MEV and volatile gas can affect final execution even when the quote looks good.

Best For: These aggregators are best suited to users who already operate in self-custody and want routing across liquidity sources without giving up control of their assets.

Avoid If: If you need built-in fiat on-ramps/off-ramps and a fully custodial “account” experience, DEX aggregators may feel inconvenient.

Pros: Self-custody gives you more direct control over assets and execution settings compared with most centralized venues.

Cons: Gas and execution uncertainty can make total costs less predictable, especially on mainnet or during congestion.

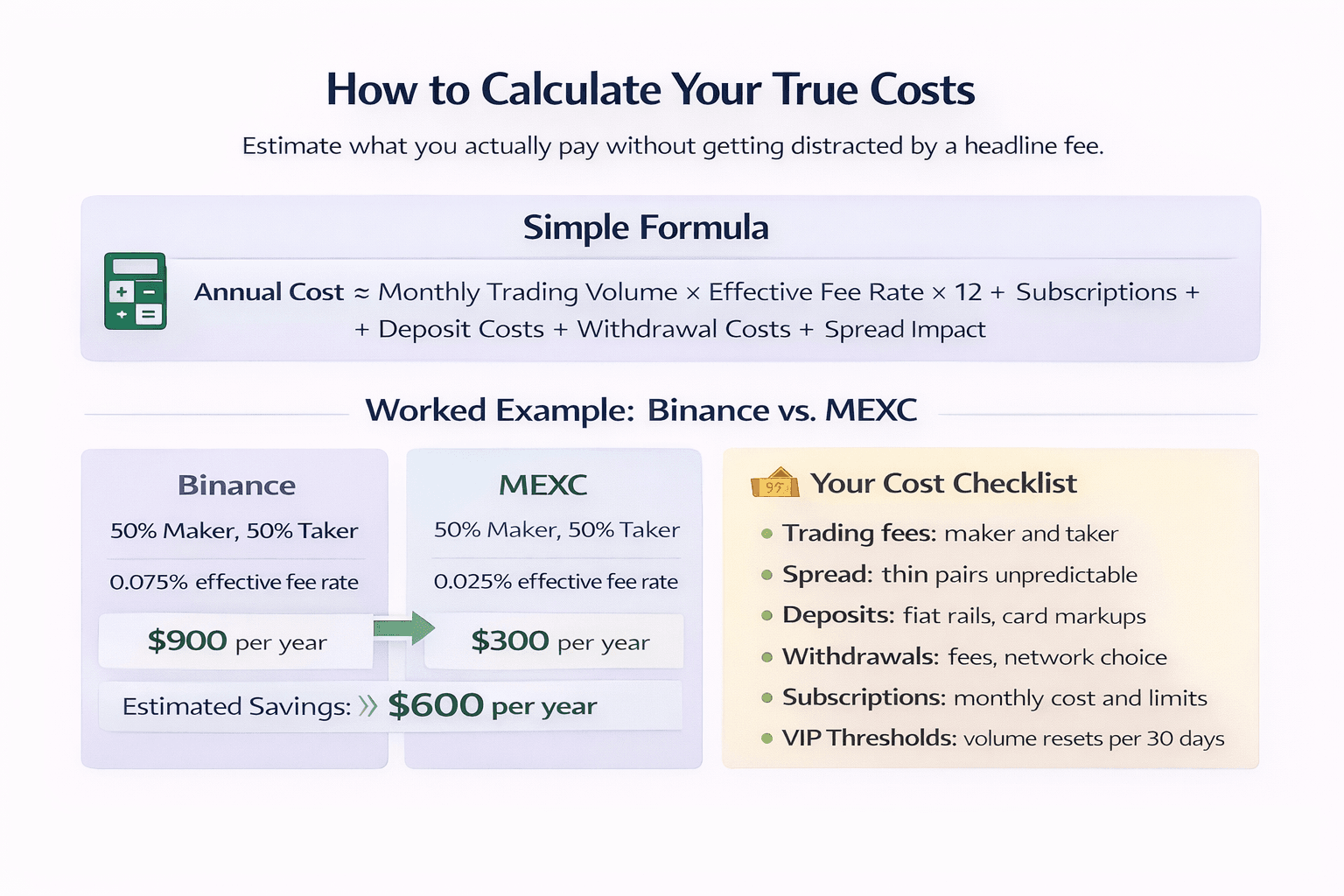

How to Calculate Your True Costs

This is the simplest way to estimate what you actually pay over time, without getting distracted by one headline fee.

If You are Good at Trading Math, You can Remain on Top of What You are Actually Paying

If You are Good at Trading Math, You can Remain on Top of What You are Actually PayingThe Simple Formula

Annual cost estimate

Annual cost ≈ (Monthly trading volume × Effective fee rate × 12) + Subscriptions + Deposit costs + Withdrawal costs + Spread impact

Worked example: Binance with BNB vs MEXC

Assume $100,000 spot volume per month, with 50 percent maker and 50 percent taker.

- MEXC spot fees are 0.00 percent maker and 0.05 percent taker, so the effective rate is 0.025 percent.

- Binance spot fees are 0.10 percent maker and 0.10 percent taker, and using BNB for fee payments applies up to a 25 percent discount, making the effective rate 0.075 percent.

Math

- MEXC: $100,000 × 0.00025 × 12 = $300 per year

- Binance with BNB: $100,000 × 0.00075 × 12 = $900 per year

Estimated savings: $600 per year

Your Cost Checklist

- Trading fees, maker and taker.

- Spread, especially on smaller pairs.

- Deposits, fiat rail costs and card markups.

- Withdrawals, network choice and withdrawal frequency.

- Subscriptions, monthly cost and limits.

- VIP thresholds and whether tiers reset on a 30 day window.

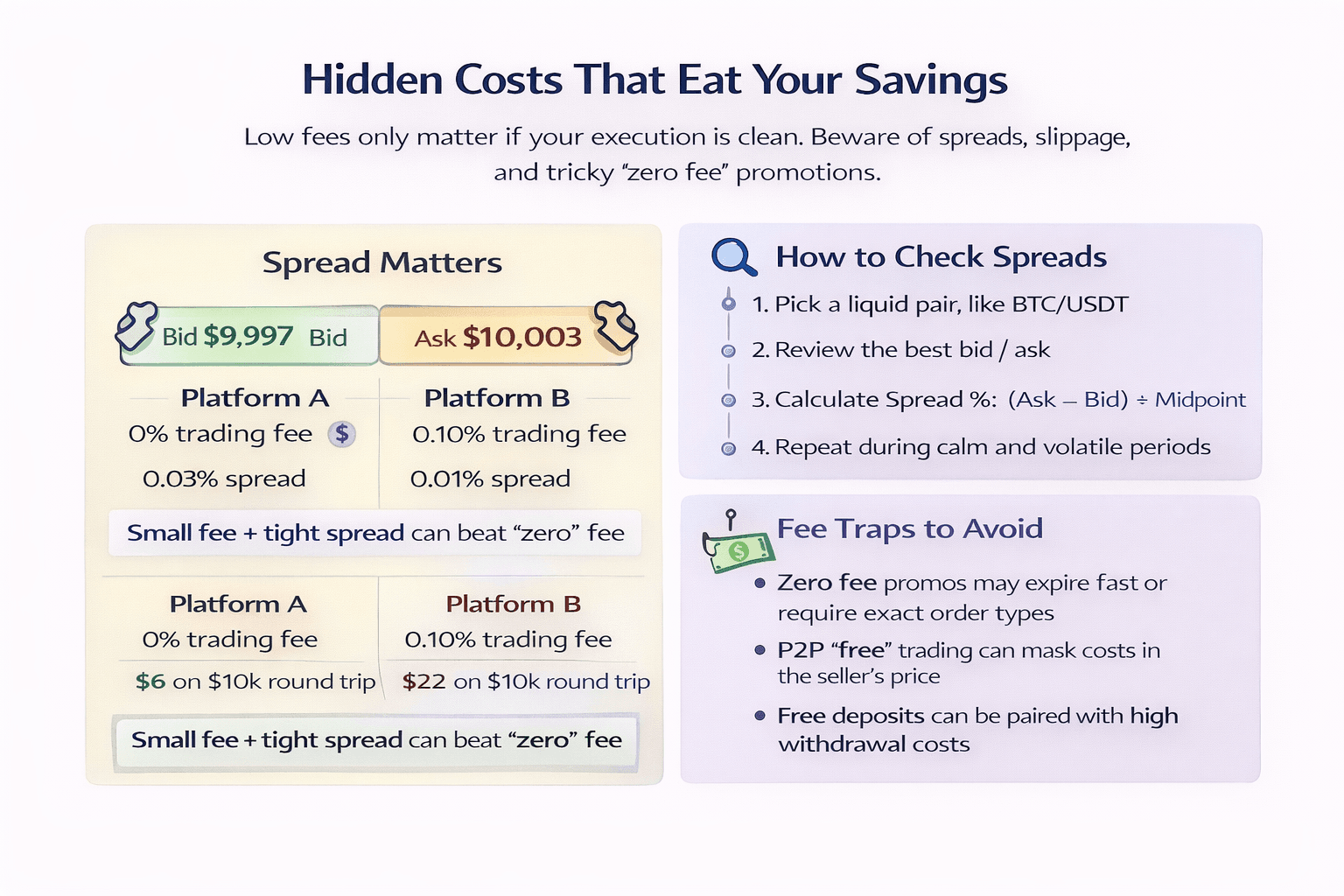

Hidden Costs That Eat Your Savings

Low fees only matter if your execution is clean. Many “cheapest exchange” claims fall apart once you include spreads, slippage, and the fine print attached to promotional pricing.

Low Fees Only Matter if Your Execution is Clean

Low Fees Only Matter if Your Execution is CleanSpreads: The “Zero Fee” Trap

Here is the simplest illustration of why a zero fee headline can be misleading:

- Platform A: 0 percent trading fee, 0.03 percent spread

- Platform B: 0.10 percent trading fee, 0.01 percent spread

On a $10,000 buy and sell round trip, Platform A can cost about $6 in spread, while Platform B can cost about $2 in spread plus about $20 in fees, for about $22 total. In this example, Platform A is cheaper even though it has the worse spread. If the spread gap widens, the result can flip quickly. That is why you should treat spread like a hidden fee that is paid every time you enter and exit.

How to check spreads

- Pick a liquid pair, like BTC USDT, and a thin pair you actually plan to trade.

- Look at the best bid and best ask on the order book.

- Calculate spread percent as: (Ask minus Bid) divided by the midpoint, multiplied by 100.

- Repeat the check during a quiet period and during a volatile period.

- If you use market orders, also compare your filled price to the pre trade midpoint to see slippage.

A helpful mental model is buying and selling currency at an airport. Even if the booth says “no commission,” the rate can still be worse than a booth that charges a small fee but gives a tighter rate.

Fee Traps to Avoid

- Promotional zero fee pairs can apply only to specific markets, time windows, or order types, so your next trade may not qualify.

- P2P “free” deals often hide costs in the seller’s price, which can be worse than paying a visible exchange fee.

- Free deposits can be paired with expensive withdrawals, so check withdrawal costs before you fund heavily.

- Tier resets can move you back to a higher fee level if your trailing volume falls, which is common for seasonal traders.

- Low liquidity pairs can turn a small fee into a rounding error, because slippage and partial fills can dominate your total cost.

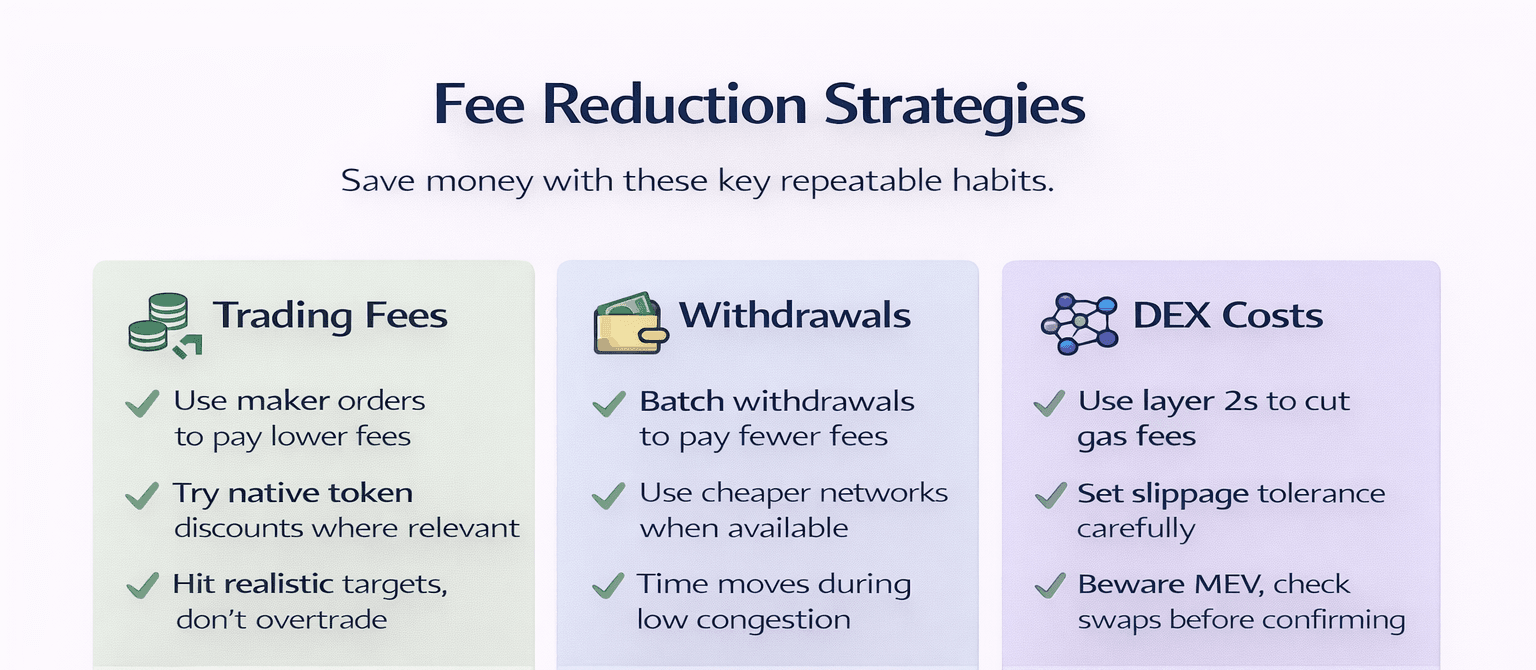

Fee Reduction Strategies

The biggest savings usually come from a few repeatable habits. The goal is to reduce what you pay per trade and also cut the “invisible costs” that show up when you move funds or trade thin markets.

The Biggest Savings Usually Come from a Few Repeatable Habits

The Biggest Savings Usually Come from a Few Repeatable HabitsMaster Checklist (Trading Fees)

- Use maker orders when you can, especially on liquid pairs, because maker fees are often lower than taker fees.

- Use native token discounts when they fit your workflow, such as BNB trading fee discounts, and check whether your exchange supports similar reductions through its own token.

- Hit VIP tiers only if the volume target is realistic, because chasing a tier can lead to overtrading that costs more than it saves.

- Watch promotional zero fee pairs, but treat them as temporary. Always confirm the pair and the order type qualify before you assume your next trade is also discounted.

Master Checklist (Withdrawals)

- Batch withdrawals so you pay one network fee instead of many, especially when moving the same asset repeatedly.

- Use cheaper networks when appropriate, such as choosing USDT on TRON rather than USDT on Ethereum if both are supported, and you control the destination network.

- Time withdrawals during lower congestion, since some networks and services price transfers based on demand.

- Avoid withdrawing dust assets repeatedly. Small balances can get eaten by fixed fees over time, so it is often cheaper to consolidate before moving funds.

Master Checklist (DEX Costs)

- Use L2 networks when possible, because L2s are designed to reduce transaction costs compared with Ethereum mainnet, and Ethereum’s own documentation explains gas and transaction fees.

- Set slippage carefully. Too low can cause failed transactions, too high can lead to poor execution, especially on volatile tokens.

- Beware MEV and routing. Aggregators can improve price discovery, but you should still check price impact and minimum received before confirming a swap.

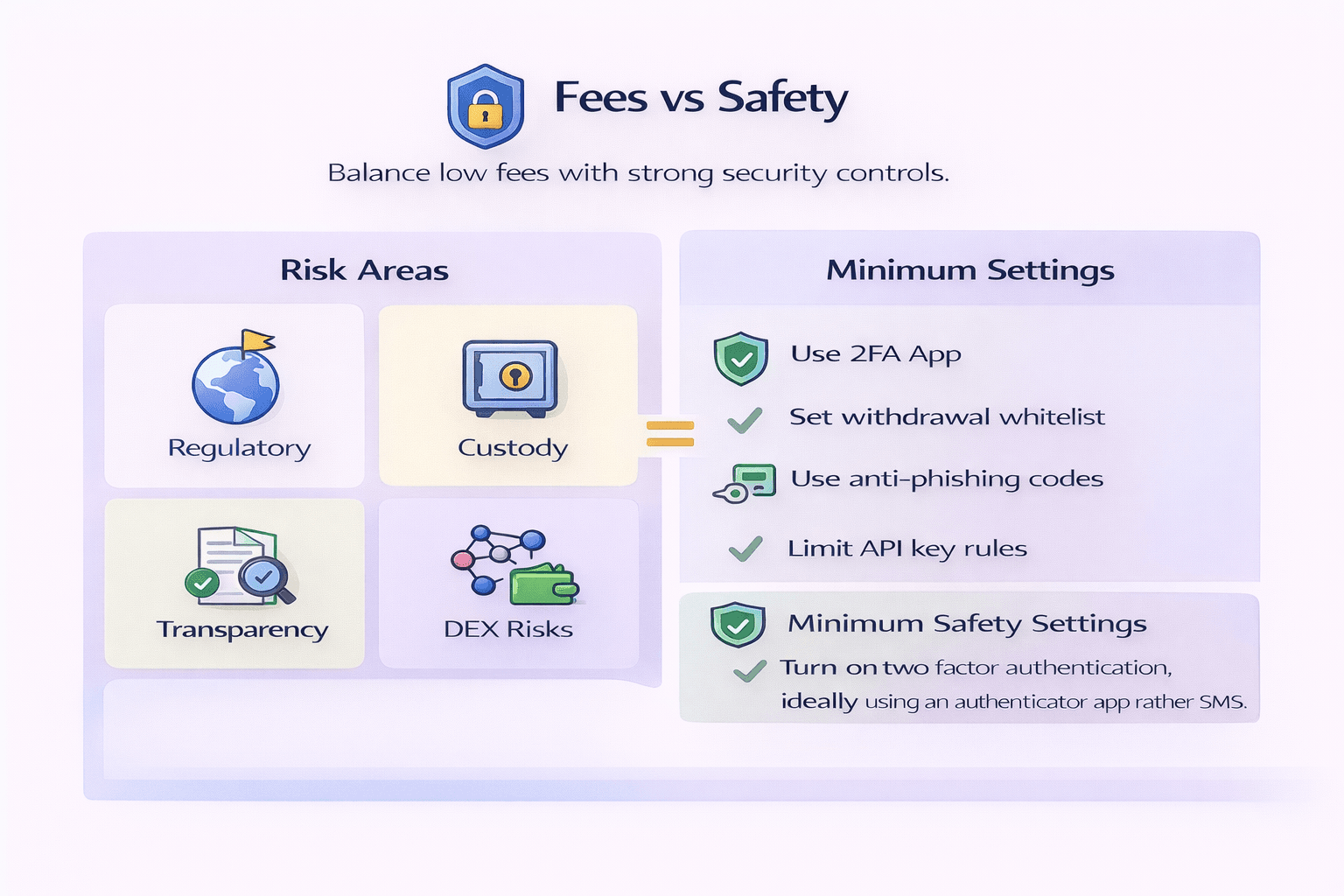

Fees vs Safety

Low fees are only a win if the platform is trustworthy and your account is protected. A slightly higher fee can be a reasonable trade if it comes with clearer rules, stronger controls, and better transparency.

Low Fees are Only a Win if the Platform is Trustworthy and Your Account is Protected

Low Fees are Only a Win if the Platform is Trustworthy and Your Account is ProtectedLow Fees ≠ Low Risk

Low fees can be appealing, but they are only one part of the decision. An exchange that looks “cheaper” on paper may carry higher risks tied to where it operates, how it safeguards customer funds, and how transparent it is about reserves and operations. On the other side, using a DEX can remove custody risk, but it shifts more responsibility to you and adds smart contract and wallet security risks. With that context, here are the main risk areas to keep in mind:

- Regulatory coverage reality: The same brand can operate under different regional entities, and product access can change by country, especially for derivatives.

- Custody risk: Centralized exchanges hold customer assets, so your exposure includes operational failures, hacks, and account level compromises.

- Proof of reserves and transparency: Public reserve attestations can improve visibility, but they are not the same as a full audit of liabilities and controls.

- DEX smart contract risk: Self custody swaps remove exchange custody risk, but introduce wallet security risks plus smart contract and routing risks that can lead to losses.

Minimum Safety Settings

- Turn on two factor authentication, ideally using an authenticator app rather than SMS.

- Enable a withdrawal address whitelist, and add a new address only after careful verification.

- Use anti phishing codes in emails, and bookmark the real domain to avoid lookalike sites.

- Restrict API keys to read only unless you truly need trading access, and always limit permissions and IP addresses where supported.

For more details, do check out our guide on risk mitigation to better equip yourself on your trading journey.

Final Thoughts

Picking the “lowest fee” crypto exchange is a bit like picking the cheapest flight. The ticket price matters, but so do the baggage fees, seat selection, and whether you end up stranded in a different airport. Trading fees are only the headline number. Spreads, withdrawal costs, VIP tiers, and subscription limits are the extras that quietly decide what you really pay.

The good news is that you do not need to memorize fee charts to get this right. Start by matching the platform to your style, spot or perps, maker or taker, and your monthly volume. Then run the simple dollar math, sanity check spreads on the pairs you actually trade, and lock down security settings before you fund anything meaningful. Do that, and “low fee” stops being marketing and starts being a repeatable advantage.

Also on The Coin Bureau

Most Secure & Trusted Crypto Exchanges

Top No KYC Crypto Exchanges

Top Fiat-to-Crypto Exchange Platforms

Top Crypto Exchanges For Day Trading

Top US Crypto Exchanges

Best Crypto Exchanges for Beginners

Top Altcoin Exchanges

Top Crypto Futures Exchanges

Top Exchanges For Swing Traders

Top Crypto Exchanges For Shorting

Top Crypto Exchanges For Scalping