September 21, 2020, was the culmination of a set of ideas that were put down on paper back in 2018 regarding how to create a smart contract platform that’s both scalable and offers high performance.

That idea was and is Avalanche, and while the main net launch on September 21 was the culmination of the ideas in that early whitepaper, it is also just the start for the Internet of Finance as Avalanche democratizes financial markets and bridges all blockchain platforms together into one interoperable ecosystem.

Avalanche & Ava Labs Logos

Avalanche & Ava Labs Logos Avalanche is the open-source blockchain that bridges the needs of developers and users. With it, new blockchains can be created that run on the rules the developer specifies. New assets can be created and coded to obey specific parameters and trading restrictions. And scalable smart contracts and dApps become a reality.

Ava Labs, the developers of Avalanche, have said that this is the first blockchain that can handle smart contracts and also conduct transactions in under a second.

Below we will learn much more about Avalanche and how it is bringing smart contracts and decentralized finance both into the future.

Smart Contract Platforms

In the beginning, there was Bitcoin. It was created as a way to store and transfer value in a permissionless fashion without the need for a trusted third party. Anyone can use the Bitcoin blockchain to store or transfer value at any time and at any place.

All that’s needed is a network connection. It has been compared to gold as a store of value, but it is actually quite different from gold. And yet the use cases for Bitcoin remain limited in a similar fashion to gold.

Then Ethereum joined the world of decentralized blockchains. It was created not only to host data like blockchains created before it, but was a living network that could actually host and run decentralized applications based on the blockchain. It fundamentally changed the utility of the blockchain.

Bitcoin vs. Gold remains an unanswered question.

Bitcoin vs. Gold remains an unanswered question. Smart contracts are ideal for financial applications since they live on the blockchain and once created will execute automatically whenever their conditions are met. This allows developers to build complex and sophisticated applications that can do far more than store and transfer value.

The dApps created can make calls to any of the smart contracts living on the blockchain to perform specialized tasks whenever certain conditions are met. This allows for things like issuing collateralized loans or trading assets without the need for a centralized authority.

Once developed, these systems will run on their own, and this can allow for the creation of unique new business models that will replace our traditional financial systems with peer-to-peer decentralized solutions.

This is where Avalanche comes into the picture.

What Makes Avalanche Special?

Many blockchain enthusiasts will recognize Avalanche as similar to Ethereum in as much as it is an open-source blockchain platform that allows anyone to write and deploy smart contracts, and to build decentralized applications. However, there is a key difference that makes Avalanche special.

That difference?

What Makes Avalanche Different? Image via Avalanche

What Makes Avalanche Different? Image via Avalanche Avalanche was developed as a platform that allows anyone to build their own blockchain. It was created to be modular and customizable, and brings security, scalability, and high performance to a smart contract platform.

Consider these four unique features of the Avalanche platform:

- Modular. Avalanche makes it possible for anyone to use the building blocks of the platform to build a standardized blockchain that can be either public or private and is application-specific. These newly created chains are also interoperable and exist on a common blockchain network. Avalanche is an ecosystem of blockchains and can be extended to fulfil any specific need without being limited to the lowest common denominator of the system.

- Customization. With Avalanche a developer has complete control over how the smart contracts behave. They can control who can view and interact with the dApp, who can control it, and which virtual machine or programming language it executes with. And it allows for decentralized financial applications through the creation of smart assets. These are arbitrarily complex digital assets that include their own custom rules.

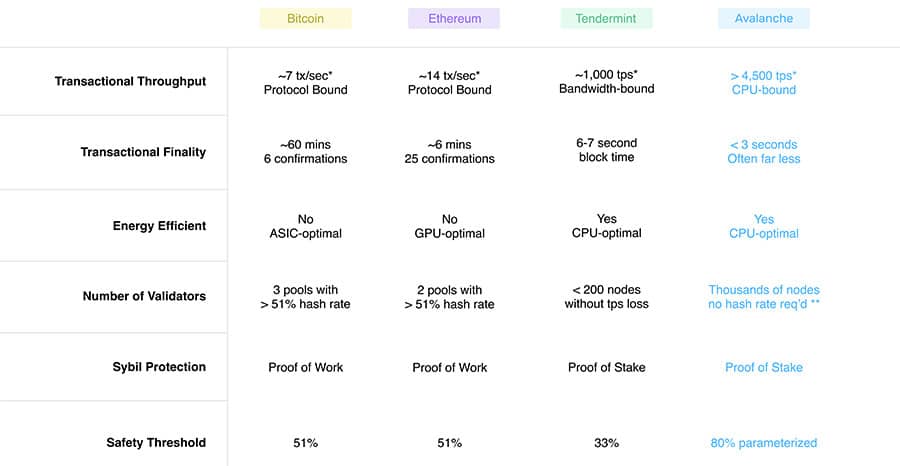

- Scalable and Secure. The Avalanche blockchain uses a Proof-of-Stake (PoS) consensus mechanism to provide Sybil protection to the blockchain. This PoS system gives tens of thousands of validators a say in the system, ensuring that the network remains resistant to attacks, robust, and reliable.

- High Performance. Avalanche has created a new family of protocols it calls the “Snow family” that enable all the chains built on Avalanche to handle thousands of transactions per second. It also enables these chains to finalize their transactions within seconds rather than hours.

The Snow Family of Protocols

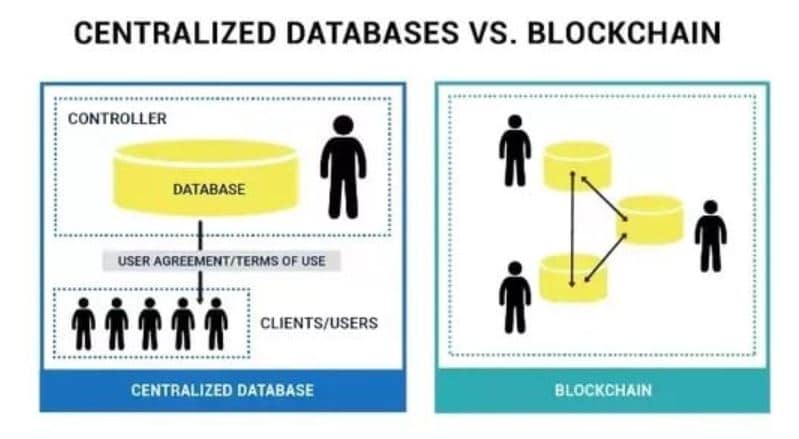

Blockchains are really nothing more than distributed and decentralized databases that are designed to satisfy three properties:

- Readable by anyone;

- Writable by anyone;

- Inalterable by anyone.

The dilemma of the decentralized database is real. Image via https://intellipaat.com

The dilemma of the decentralized database is real. Image via https://intellipaat.com Data scientists struggled for decades with a dilemma in creating public databases. That dilemma was if anyone can participate in the network how could they ensure that only valid transactions would be included in the database?

The solution was the public blockchain, a type of distributed database that consists of a network of computers that communicate with each other in a peer-to-peer fashion in order to complete tasks (such as validating transactions) in a coordinated manner. In order to accomplish this consensus protocols are included to instruct the computers on which transactions are considered valid.

The first consensus protocols used in the creation of blockchains are the Nakamoto consensus protocols, which rely on Proof-of-Work mining and the longest-chain rule. The most well-known of these blockchains are Bitcoin and Ethereum in its current implementation.

What is Blockchain? Image via Shutterstock

What is Blockchain? Image via Shutterstock While these blockchains are decentralized and robust, they suffer from issues such as low throughput and high confirmation latencies. Plus, they require constant and huge energy expenditures to ensure their security.

There are also the classic consensus protocols like Cosmos Tendermint which use an all-on-all communication to ensure that all the computers in the network reach the same decision with absolute certainty. This solves the problems of low throughput and high confirmation latencies but introduces a lack of robustness during membership changes. Plus the networks using these classic consensus protocols do not scale well.

How does Avalanche consensus compare? Image via Avalanche blog.

How does Avalanche consensus compare? Image via Avalanche blog. The Snow family of protocols that have been developed for Avalanche combine the best properties of Nakamoto consensus (robust and highly decentralized) with the best of the classical consensus protocols (low latency, high throughput, lightweight).

Snow Protocol Properties

One of the immediately recognizable features of the Snow protocols is that they are extremely fast. They achieve irreversible finality in under 2 seconds, which is faster than all current point-of-sale systems. They will also support thousands of transactions per second, which is far greater than the throughput seen with current payment processing systems.

The Snow protocols do this by using repeated random sub-sampled voting. This works by having each validator query only a small, random sampling of other validators each round. The selected validators are weighted by stake amount, and this methodology allows the protocol to theoretically scale to millions of participants.

The Snow protocols are both lightweight and use minimal energy. When there is no work to do the protocol goes quiescent and waits in a low-energy state.

Energy is spent while doing work. Image via Avalanche blog.

Energy is spent while doing work. Image via Avalanche blog. And the Snow protocols are extremely secure. While other consensus protocol families are susceptible to a number of attack vectors, the Snow protocols are immune to these attacks. With a huge number of validators, there is guaranteed immutability and censorship resistance that PoW protocols are unable to achieve. In other PoS systems, scaling is attempted through the delegation of validation to a small subcommittee, but this creates a situation where it becomes possible to corrupt the subcommittee membership. Snow protocols do not depend on delegation since every single validator is able to participate in reaching consensus.

How Do Snow Protocols Work?

When any validator sees a transaction that needs to be validated it will randomly select a small subset of other validators if they believe the transaction is valid or not. The other validators will either respond that they believe the transaction to be valid, or will respond that they believe the transaction is invalid and should be rejected. This can happen when the node has already rejected the transaction, or if it prefers a conflicting transaction. Each of the validators will have their own strong opinion regarding the validity of any transaction.

When a large enough portion of the subset of validators respond that a transaction is valid and should be accepted the initial validator will agree to accept the transaction. This validator now believes the transaction is valid and if queried by another validator in the future it will respond that the transaction is valid and should be accepted. In the same way, if a large enough portion of the subset of validators responds that the transaction is invalid then this initial validator will reject the transaction and will advise all future validators to reject the transaction as well.

Default Subnets on the Avalanche platform. Image via Avalanche blog.

Default Subnets on the Avalanche platform. Image via Avalanche blog. In the majority of common cases, the finalization of a transaction can happen very quickly. If there exists a case where there are conflicts between transactions the honest validators will quickly come together to determine which of the conflicting transactions is preferred.

This will generate a positive feedback loop until all of the participating validators prefer a single transaction over all others. That will lead to this transaction being accepted by the network as valid, while all other conflicting transactions are rejected. It is this cascading property in validating transactions that gives Avalanche its name.

In the Snow protocol there is a high probability guarantee that when any of the honest validators accepts or rejects a transaction, all of the other honest validators will also follow suit and accept or reject that transaction.

Avalanche Platform Architecture

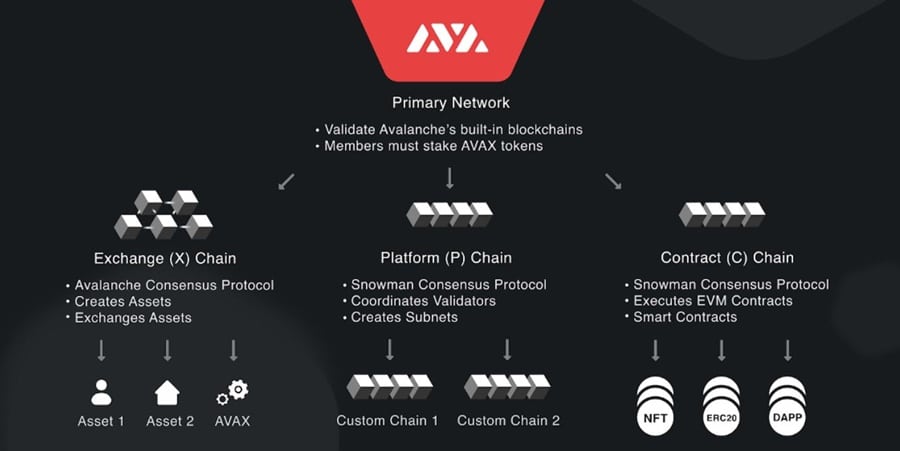

The already discussed Snow protocols form the basis for consensus on the Avalanche blockchain. There are two consensus engines on the platform:

- Avalanche (DAG-optimized consensus): high-throughput, parallelizable, and simple to prune.

- Snowman (chain-optimized consensus): high-throughput, totally-ordered, and best for smart contracts.

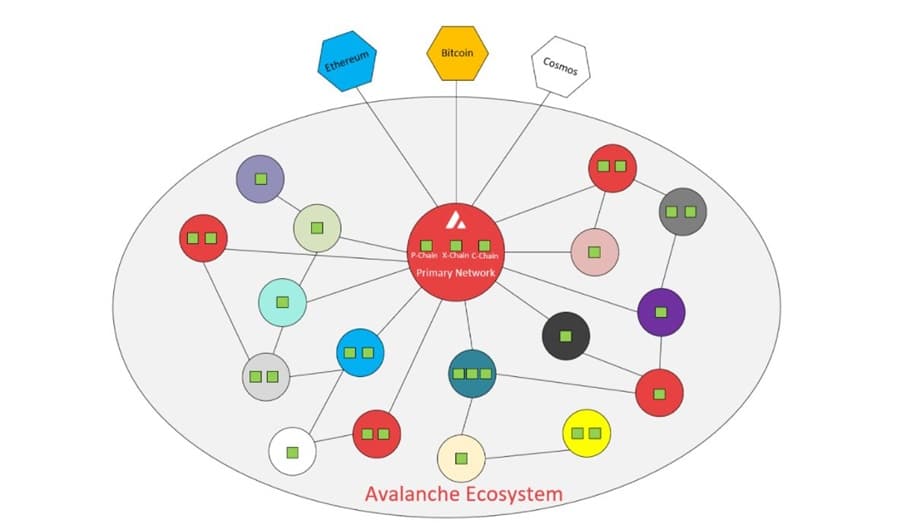

Everything in the Avalanche network is created as a sub-network (subnet) with every chain being included as a part of one or another subnet. Each subnet is a subset of the entire validator set, or those computers that have agreed to participate in the network to validate a group of chains. Each subnet creates its own incentive scheme for validators. Participating in subnets is optional for validators for all the subnet with the exception of the Default Subnet.

Circles represent different subnets and green squares represent blockchains within those subnets. Image via Avalanche blog.

Circles represent different subnets and green squares represent blockchains within those subnets. Image via Avalanche blog. In Avalanche there are 3 blockchains that have been built-into the platform, and all 3 are validated by the Default Subnet. These 3 default blockchains are as follows:

- The X-Chain is a DAG-based payment chain for creating and trading smart digital assets (i.e., a representation of a real-world thing with a set of rules that govern its behavior). One of the assets traded on the X-Chain is $AVAX, the network's native token. When one issues a transaction to a blockchain on the Avalanche network, they pay a fee denominated in $AVAX. The X-Chain is an instance of the Avalanche Virtual Machine (AVM).

- The P-Chain manages metadata about the Avalanche network. Its API allows nodes to create subnets, add validators to subnets, and create blockchains.

- The C-Chain is an instance of the Ethereum Virtual Machine, powered by Avalanche’s consensus protocol. One can create smart contracts on the C-Chain and do anything else they would do on Ethereum by using the C-Chain’s API.

In addition to these 3 default chains Avalanche is capable of supporting multiple other chains and their own custom virtual machines. This feature allows developers to create custom dApps and blockchains containing any arbitrary logic they choose to include.

Avalanche Network Functionality

There are a number of characteristics and features that provide Avalanche with its unique functionality.

Subnet Design and Incentives

Developers are able to create their own subnets, and these can accommodate various use cases. One of the features of subnet design is the ability to customize the chains and incentive schemes used. This allows the number of validators to scale infinitely in theory, and each validator is able to opt-in to any of the subnets for which they are interested in performing validating services.

Compliance tools built into the blockchain. Image via Weforum.org

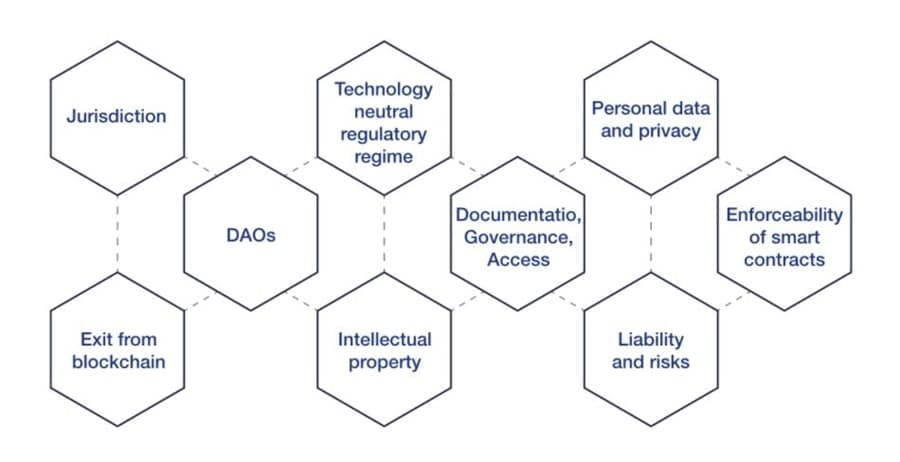

Compliance tools built into the blockchain. Image via Weforum.org Regulatory Compliance

Avalanche is at its heart a DeFi platform that was created with financial use cases firmly in mind. This has led to regulatory compliance being built into Avalanche. A developer is able to design a subnet so that it requires users to meet a number of requirements. These include being located in specific countries, holding certain licenses, or passing KYC/AML checks. This novel approach allows for the development of more efficient financial solutions that wouldn’t be feasible or even possible otherwise.

Athereum = Avalanche + Ethereum

Athereum is an Avalanche subnet that is a friendly fork of Ethereum utilizing the Avalanche consensus engine. This will allow the subnet to have high throughput and nearly instant finality. Aethereum developers will be able to use the full suite of Ethereum development tools (Web3js, MyEtherWallet, MetaMask, etc.). In addition, when the Ethereum state is ported to Avalanche all the existing holders of ETH with also have access to an equal amount of ATH, the native asset of Aethereum.

Governable Transaction Fees

Avalanche will allow validators to extract their own fees according to their own custom algorithms. Fees are essential for incentivizing validators and for distributed denial-of-service (DDoS) protection across all blockchains.

Create and distribute your own assets. Image via AvaLabs.org

Create and distribute your own assets. Image via AvaLabs.org Smart Asset Creation

Avalanche will allow developers to easily create digital smart assets, and will have support for also trading those assets easily. This will be handled through complex rulesets that define the handling of the asset. These digital assets could be created to represent real-world physical assets such as equities, gold, real estate, bonds, and many other asset types. Each subnet will be capable of managing its own assets and both fungible and non-fungible tokens are supported.

Atomic Commitment Across Subnets

Because subnets are always using the same underlying protocol for consensus, automatic commitment of transactions across multiple subnets will be enabled. This will allow validators to verify transactions across multiple subnets.

Governance Parameters

Stakeholders will be able to adjust key economic parameters of the system, according to changing external circumstances. Key parameters (e.g., minimum staking amounts and rewards rate) can be modified dynamically while maintaining the supply cap intact.

Principles of good blockchain governance. Image via Shutterstock

Principles of good blockchain governance. Image via Shutterstock A revolutionary consensus protocol has given Avalanche a significant performance advantage over existing blockchains, however, the developers are well aware that there is room to improve on the current implementation. The development team at Ava Labs is exploring a number of potential improvements to the platform, including pruning, blockchain sandboxing, database upgrades, networking improvements, post-quantum and privacy virtual machines, and a new leadered consensus mechanism named Frosty. Those are just a few of the improvements being actively explored.

The AVAX Token

The native token used on the Avalanche platform uses the ticker symbol AVAX. It is the main accounting unit for the network, serving as a peer-to-peer payment currency, as well as a means to secure the network, to deploy new subnets, to pay transaction fees, to create and exchange assets, to govern the protocol, and to incentivize validators.

The AVAX token bridges platform and development. Image via Medium.com

The AVAX token bridges platform and development. Image via Medium.com AVAX was created with a capped supply of 720 million tokens, 360 million of which were released with the genesis block of the main net. The remaining 360 million tokens are being minted in accordance with an equation in the Avalanche whitepaper. In the first year, the staking reward aims to target a minting rate of new AVAX tokens at 7-12%. While the total supply of AVAX cannot be changed, it is possible for the token holders to change the emission rate of new tokens in order to adapt to changing economic conditions.

Avalanche held an ICO in July 2020, raising $42 million and selling 21 million AVAX tokens for $0.50 each. AVAX skyrocketed to $11.46 the day after the main net launched and the Avalanche coin was among the strongest performers in the 2021-2022 bull run, hitting an all-time high of $134 in Q4 of 2021.

AVAX Price Performance in the 2021-2022 bull run. Image via CoinGecko

AVAX Price Performance in the 2021-2022 bull run. Image via CoinGeckoLike the rest of the crypto industry, Avalanche's price crashed in the 2022-2023 crypto winter to a low of around $10 where it was range-bound for months.

As we enter the 2024 bull run, we see the Avalanche price experiencing bullish price patterns and positive price action as investors and users alike are clearly long-term bullish on the project.

AVAX is Looking Strong as we Head Into 2024. Image via CoinGecko

AVAX is Looking Strong as we Head Into 2024. Image via CoinGeckoIn the Avalanche network, any validating node is able to mint new tokens by staking its existing tokens and actively participating in the consensus of the network. Minting rate is determined by the percentage of the total supply staked by the node, the duration of the stake (using a minimum of 2 weeks and a maximum of 1 year), node uptime, and node latency.

Currently, the Snow family of protocols is a family of leaderless Byzantine fault-tolerant protocols. This means that the need for staking pools is eliminated since all of the validating nodes in the network are rewarded proportionally for their services to the network, keeping reward variance to a minimum at all times. Plus, transaction fees are burned rather than being distributed to validators, which serves to increase the scarcity of AVAX tokens over time.

By taking advantage of the flexibility and customization of the Snow protocol through its governance, Avalanche is trying to make the best of both Austrian and Keynesian economic principles to eventually reach steady growth and economic equilibrium.

It is hoped that a network will develop with a significant amount of users who are constantly transacting, which signals a useful and healthy economy. The network also hopes to develop very low fees and low minting in order to keep stability in the deflationary effects of burning transaction fees.

The Avalanche Team

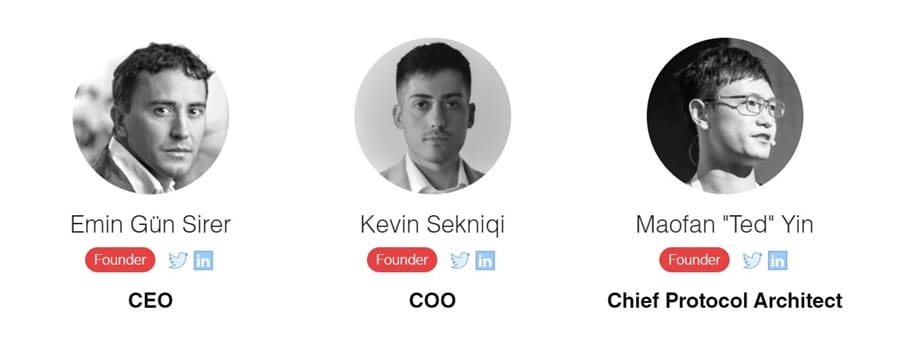

Avalanche and the Ava Labs development team behind the Snow protocol were founded by a trio of computer scientists led by Emin Gun Sirer, a veteran computer scientist who has a long history with Bitcoin, decentralized networks, and blockchains.

Dr. Emin Gun Sirer is the CEO of Ava Labs and is a long-time blockchain leader who has helped in developing scaling for Bitcoin. The creation of the Snow protocol was a direct follow-up to that work. He received a PhD in Computer Science in 2000 and has been a professor at Cornell University since 2001. He was also a key member of the IC3 (The Initiative for Cryptocurrencies and Contracts).

The 3 Avalanche co-founders. Image via AvaLabs.org

The 3 Avalanche co-founders. Image via AvaLabs.org Co-founder Kevin Sekniqi is the COO at Ava Labs and is also a Cornell professor and a former member of the IC3. Prior to joining Ava Labs Sekniqi was a researcher at the NASA Jet Propulsion Laboratory and at a number of universities. His most recent position prior to Ava labs was with Microsoft as a Research Software Engineer, and in 2020 he received a PhD in Computer Science from Cornell University.

The third co-founder of the project is Maofan “Ted” Yin, a protégé of Dr. Sirer and the Chief Protocol Architect for Ava Labs. He is due to receive his PhD in Computer Science from Cornell University in 2021.

In addition to the three founding members, the Ava Labs team has grown to include 45 other individuals in roles that stretch from computer science and engineering to economics and finance. There are also a number of marketing and law experts on the team.

Avalanche's Recent Partnerships and Developments

Avalanche stands out with its innovative architecture and robust ecosystem. Recent developments have further cemented its position in the crypto world, thanks to strategic partnerships and groundbreaking updates. From enhancing interoperability with a Bitcoin bridge to expanding its NFT marketplace reach and forging significant collaborations, Avalanche is pushing the boundaries of what's possible in blockchain technology. These updates not only reflect Avalanche's commitment to growth and innovation but also highlight its increasing influence and integration within the wider crypto ecosystem.

- Bitcoin Bridge Launch: In June 2022, Avalanche introduced a Bitcoin bridge, enabling users to transfer Bitcoin to the Avalanche network. This development allowed for the utilization of BTC within Avalanche's DeFi ecosystem, achieving a significant milestone as the amount of BTC bridged surpassed that held in the Lightning Network, peaking at 5,700 BTC, according to Dune Analytics.

- OpenSea Integration: OpenSea, a leading NFT marketplace, expanded its platform to include Avalanche in October 2022. This integration broadened the horizons for NFT enthusiasts and creators within the Avalanche ecosystem.

- Partnership with Alibaba: In December 2022, Avalanche formed a partnership with Alibaba Cloud. This collaboration aimed to simplify the process for users to launch Avalanche validators, enhancing the network's accessibility and scalability.

- Avalanche Warp Messaging (AWM): AWM was launched to facilitate cross-chain communication between Avalanche subnets. This protocol enabled several capabilities, such as seamless oracle network connections, token transfers between subnets, and state sharding across multiple subnets, thus bolstering the interoperability within Avalanche's ecosystem.

- Hyper SDK Release: Avalanche introduced the Hyper SDK, a comprehensive toolkit designed for developers to build custom virtual machines on Avalanche. This SDK is pivotal for fostering innovation and tailor-made solutions on the network.

- Partnership with Merit Circle DAO: In April 2023, Avalanche and Merit Circle DAO partnered to unveil 'Beam,' a gaming-focused subnet. Beam has emerged as one of the leading projects in the web3 space, showcasing Avalanche's commitment to expanding its reach and utility in various sectors.

- Launch of Inscriptions: Similar to Bitcoin inscriptions, Avalanche unveiled its own version of Inscriptions in January 2024, marking another milestone in its journey to provide a robust and versatile blockchain platform.

- Vyrx Scaling Solution: Also in January 2024, Ava Labs announced Vyrx, a new scaling solution capable of achieving up to 100,000 transactions per second (tps), highlighting Avalanche's continuous efforts to enhance scalability and performance.

These updates signify Avalanche's robust growth and expanding ecosystem, showcasing its adaptability and commitment to innovation in the blockchain space.

Avalanche Unofficial Roadmap 2024

Avalanche co-founder Kevin Sekniqi recently shared a tech roadmap on Twitter, outlining his vision for the network's evolution. This isn't an official roadmap, but it gives a glimpse into the potential future developments for Avalanche. The roadmap underpins eight milestones that seek to prime Avalanche to address the growing trends in Web3 and also improve on its strengths.

Milestone 1: Base Layer Consensus Improvements

Kevin's vision to reduce the time to finality to under 250ms and introduce an "optimistic fast finality" mode is ambitious. This initiative seems to echo Ethereum's efforts to enhance its base layer, akin to upgrades like the Denkun upgrade and the proposer-builder separation (PBS). The goal here is to offer a near-instantaneous experience for users, a significant leap towards enhancing the network's responsiveness and efficiency.

Milestone 2: Consensus Capacity Upgrades

The proposal to increase the hardware requirements for nodes on the c-chain might raise concerns about potential centralization, as higher requirements could limit the pool of potential validators. However, the actual impact will be clearer once the changes are implemented. Avalanche's emphasis on maintaining a lightweight protocol despite increased requirements indicates a balancing act between performance and accessibility.

Milestone 3: Deep Code Refactoring

Reducing reliance on the Geth codebase could streamline Avalanche's updates and maintenance, making it more agile and secure. This step is about internal optimization, crucial for the network's long-term sustainability and adaptability.

Milestone 4: Database Upgrades

Introducing FirewoodDB suggests a significant boost in transaction processing efficiency. By optimizing database interactions, Avalanche could dramatically reduce the time validators spend processing transactions, enhancing overall network performance.

Milestone 5: Subnet Upgrades

Allowing direct staking on the c-chain to launch new subnets could revolutionize how the Avalanche ecosystem expands, making it more accessible and versatile for developers and users alike. This change could catalyze innovation within the network, fostering a more dynamic and diverse ecosystem.

Milestone 6: AWM and Teleporter Enhancements

Improving the Avalanche Warp Messaging (AWM) and Teleporter could set a new standard for chain-to-chain communications, emphasizing speed and efficiency. This enhancement is pivotal for interoperability within the Avalanche ecosystem and beyond.

Milestone 7: HyperSDK Development

Enhancing the HyperSDK to offer more customization and flexibility could empower developers to innovate more freely on the Avalanche platform. This tool's evolution is key to nurturing a vibrant developer community and a range of applications on Avalanche.

Milestone 8: Promoting HyperVM

By pushing the HyperVM to the forefront, Avalanche aims to encourage the development of subnets on its native VM, potentially offering optimizations that are not feasible on other VMs like the EVM. This could lead to unique and powerful applications that fully leverage the Avalanche architecture.

Overall, this roadmap reflects a comprehensive strategy to enhance Avalanche's infrastructure, making it faster, more robust, and more adaptable, positioning it as a formidable player in the blockchain space.

Avalanche Review: Conclusion

We’ve said it before in our Youtube video, but it bears repeating here. Avalanche could be a game-changer.

Avalanche achieves sub-second finality, high throughput, and efficiency without sacrificing decentralization or security. These features not only make it an excellent DeFi platform, they also make it an excellent payments platform It can accommodate millions of validators and offers a highly customizable platform that includes interoperability between chains that will help to generate strong demand for any of the tokens created on the platform.

Supply of the AVAX token is fixed, which helps to support the price of the token and creates scarcity. And unlike other staking platforms, Avalanche doesn’t suffer from the continuous dilution caused by inflation. To help promote scarcity even further all the transaction fees and fees related to the creation of assets, blockchains, and subnets are paid in AVAX, which are then burned to reduce the total supply forever.

The ultimate goal of Avalanche is the creation of the Internet of Finance. A secure platform that is ideal for building DeFi applications and that can also accommodate the traditional finance markets. It has also been designed to make regulatory compliance a breeze, increasing enterprise adoption of the platform.

The staking system in very competitive in terms of returns, and the AVAX token is expected to be a solid long-term investment as staking encourages locking tokens for a long period of time, which also helps promote scarcity. Plus validating nodes can also validate other subnets, allowing them to receive additional rewards in the native token of the alternate subnets. All of this is designed to deliver a higher priced token over time.

As you can see, not only has the Avalanche team delivered a revolutionary consensus protocol, they have also provided everyone with a revolutionary platform where developers and users alike can take advantage of customization, flexibility, interoperability, low latency, high performance, and excellent security. In turn this could lead to mass adoption as it transforms both DeFi and traditional finance.